aurora co sales tax rate 2021

2021COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. The minimum combined 2022 sales tax rate for Aurora Minnesota is.

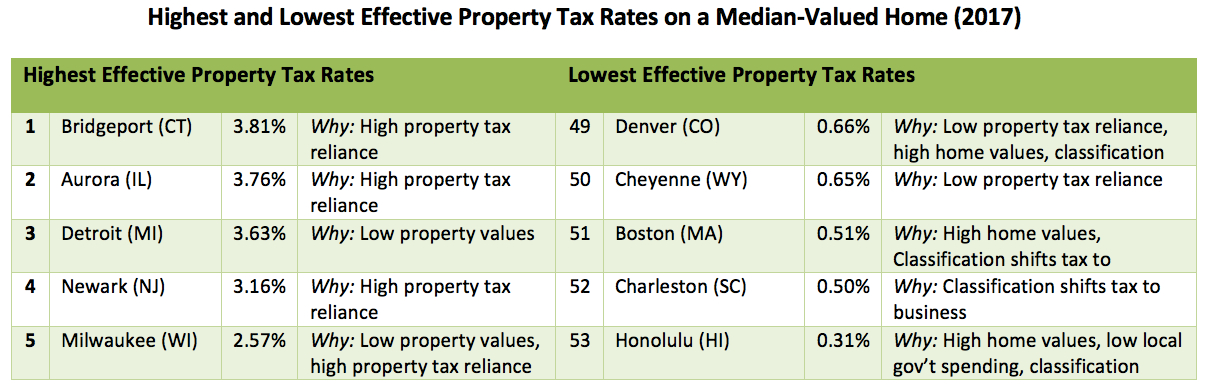

Sales Tax Rates In Major Cities Tax Data Tax Foundation

The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax.

. Ad Apply For Your Colorado Sales Tax License. 275 lower than the maximum sales tax in IL. You can print a 825 sales tax table here.

The minimum combined 2022 sales tax rate for Aurora Colorado is. Annual - Taxes due of 100 or less per year Reporting Frequency is subject to change by the. See how we can help improve your knowledge of Math Physics Tax Engineering and more.

Did South Dakota v. Aurora co sales tax rate. 31 rows The state sales tax rate in Colorado is 2900.

Sales Tax and Use Tax Rate of Zip Code 80046 is located in Aurora City Arapahoe County Colorado StateTax Risk level. Aurora-RTD 290 100 010 025 375. An Aurora Colorado Sales Tax Permit can only be obtained through an authorized government agency.

The Aurora sales tax rate is. Depending on the zipcode the sales tax rate of aurora may vary from 675 to 85 every 2021 combined rates mentioned above are the results of colorado state rate 29 the county rate 025 to 075 the aurora tax rate 25 to 3. Did South Dakota v.

80046 zip code sales tax and use tax rate Aurora Arapahoe County Colorado. ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL. 6 rows The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax.

Annually if taxable sales are 4800 or less per year if. This is the total of state county and city sales tax rates. The Colorado sales tax rate is currently 29.

Monthly if taxable sales are 96000 or more per year if the tax is more than 300 per month. The County sales tax rate is. There is no applicable county tax.

With CD 290 000 010 025 375. What is the sales tax rate in Aurora Colorado. Aurora in Nebraska has a tax rate of 55 for 2021 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Aurora totaling 0.

This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. The minimum combined 2022 sales tax rate for Aurora Colorado is 8. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec.

Real championship 2021 long spine board controversy. One of a suite of free online calculators provided by the team at iCalculator. Aurora collects a 56 local sales tax the maximum local sales tax allowed under colorado law aurora has a higher sales tax than 886 of colorados other cities and counties aurora colorado sales tax exemptions Some cities in colorado are in process.

Note that failure to collect the sales tax does not remove the retailers responsibility for payment. The minimum combined 2021 sales tax rate for aurora colorado is. The County sales tax rate is 025.

Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month. Ad Find Out Sales Tax Rates For Free. Aurora Colorado sales tax rate details The minimum combined 2021 sales tax rate for Aurora Colorado is 8.

You can print a 85 sales tax table here. While Colorado law allows municipalities to collect a local option sales tax of up to 42 Aurora does not currently collect a local sales tax. Fast Easy Tax Solutions.

The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax. The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax. This is the total of state county and city sales tax rates.

This is the total of state county and city sales tax rates. Aurora co sales tax rate 2021 Bright Home Investment Blog Uncategorized aurora co sales tax rate 2021 March 20 2021 March 20 2021 By world of cricket. The Aurora sales tax rate is 375.

Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2. Wayfair Inc affect Minnesota. With local taxes the.

4 rows Rate. 2 State Sales tax is 290Rank 46Estimated Combined Tax Rate 675 Estimated County Tax Rate 025 Estimated City Tax Rate 250 Estimated Special Tax Rate 110 and. The Colorado sales tax rate is currently 29.

For tax rates in other cities see Colorado sales taxes by city and county. The Minnesota sales tax rate is currently. Informational Bulletin - Sales Tax Rate Change Summary FY 2022-08 2 Sales Tax Rate Changes for Sales of General Merchandise Jurisdiction Combined rate ending December 31 2021 Rate Change NEW Combined rate beginning January 1 2022 Type of Local Tax Change Municipalities Addison 800 025 825 Home Rule Arcola Downtown and I-57 Business District.

None if net taxable sales are greater than 100000000. Aurora colorado sales tax rate details the minimum combined 2021 sales tax rate for aurora colorado is 8. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora.

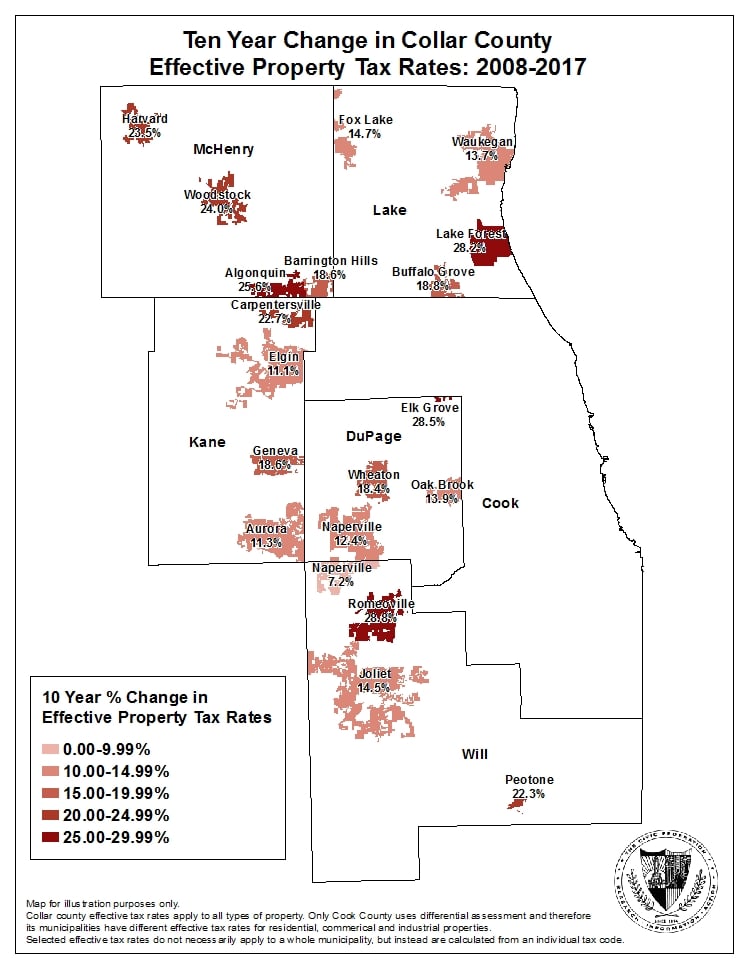

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Colorado Sales Tax Rates By City County 2022

Sales Tax Rates Douglas County Government

How Colorado Taxes Work Auto Dealers Dealr Tax

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Set Up Automated Sales Tax Center

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

Property Tax Village Of Carol Stream Il

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Activation Area Of Dholera Sir Smart City Aurora Sleeping Beauty City

U S Property Taxes Comparing Residential And Commercial Rates Across States The Journalist S Resource

Colorado Sales Tax Guide And Calculator 2022 Taxjar

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Why Identical Homes Can Have Different Property Tax Bills Lincoln Institute Of Land Policy

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation